Recent Posts

- Building a Robust and Diverse Ecosystem Innovation Ecosystem in the Animal Health Industry

- Cultivating A Champion Culture: Balancing Performance and People in Animal Health

- How Stable are Earnings in Animal Health? Results of the Animal Health Jobs 2025 Salary Survey

- Entry Fees for the Race for Talent: Results of the Animal Health Jobs 2025 Salary Survey

- Looking In The Gift Horse’s Mouth: The Pros and Cons of Counteroffers in Animal Health

Most Popular

-

How Stable are Earnings in Animal Health? Results of the Animal Health Jobs 2025 Salary Survey

-

News to Know from Brakke Consulting’s 2025 Animal Health Industry Overview

-

How Will Artificial Intelligence Change Jobs In Animal Health?

-

Entry Fees for the Race for Talent: Results of the Animal Health Jobs 2025 Salary Survey

-

Animal Health Jobs Spring 2022 Candidate Attitudinal Survey

Animal Health Jobs Spring 2022 Candidate Attitudinal Survey

Executive Summary

"Our industry is unlike any other...it feeds my soul "

This study of members of the Animal Health Jobs marketplace revisited questions posed last year1 about members' attitudes towards the animal health industry, their jobs and companies, and their perception of the future of the animal health industry. It also introduced a new section on working from home.

The positive view of the animal health industry was consistent with 2021 results. Respondents again revealed a devotion to the industry and its mission, a preference for staying in animal health, and a close ranking of the reasons for staying at their current companies. They remain engaged and committed.

The vast majority of animal health employees now work from home at least part of the time. More than 90% say the option to work from home makes a job offer more attractive. More than 80% reported being more productive working from home or in a hybrid environment. A noticeable minority do feel somewhat disconnected from their company's culture when working at home. Nearly two-thirds of animal health employees have no concerns about safely returning to the office.

As compared to the 2021 results, we note some early signals of concern around culture, employee relations and overall satisfaction at work. Wise managers would do well to pay attention. Does this signal a problem to be fixed? What are the possible solutions?

Introduction

The animal health industry includes animal feed and nutrition, precision farming and food production, pet care, veterinary services of all kinds, and diagnostics, medical devices, vaccines, and pharmaceuticals for many animal species. Whether we are pet owners, farmers, or consumers of animal products, the industry touches our lives.

Animal health, like most industries, changed during the COVID pandemic of 2020-2021. This report on the second attitudinal survey of animal health job candidates by Animal Health Jobs, a job board focused exclusively on animal health and animal nutrition, assesses the impact of those changes on employee attitudes about their jobs, their companies, and their industry.

The survey explored four areas: thoughts about the current state of the animal health industry and about its future, attitudes about participants' current jobs and companies, and in a new section, the impact of work-from-home policies.

Participants were members of the Animal Health Jobs database in February 2022. Basic statistical calculations of the results were conducted; statistical significance was set at 90% (p<0.1) and indicated in tables with an asterisk (*).

Demographics: This year's flock

Gender and geography

Study participants were 53% female and 42% male, while 1% of respondents preferred not to answer. These numbers are consistent with the 2021 participants and with the US Census Bureau's July 2021 estimates, indicating that women are 50% of the US population.2 As a profession, veterinary medicine is primarily female: 64% of all veterinarians, 62% of veterinarians in private practice and 59% of veterinarians in public and corporate jobs are women.3

Nearly all the participants (97%) were US-based. They were once again distributed across the country: 38% from the South, 25% from the West, 28% from the Midwest and 7% from the Northeast. Specific countries were not obtained for the international participants.

The pecking order: time and seniority

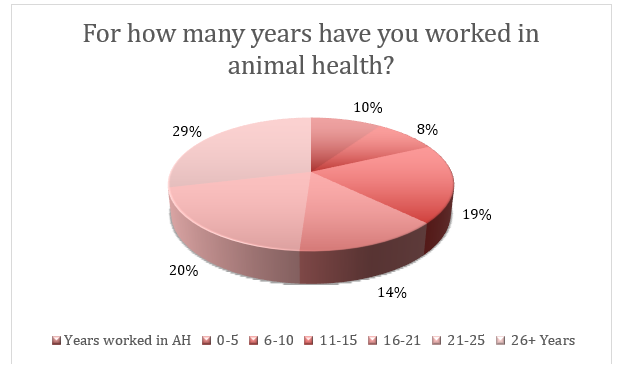

In 2022, 76% of respondents were working in animal health, a significant increase from 2021. Furthermore, 83% of those currently in the industry had spent their entire career working in animal health.

The animal health industry continues to provide many employees with a long-term home. The mean working time in the animal health industry of all respondents was 19.3 years, significantly higher than the 15.5 years reported in 2021.

Approximately two-thirds of the participants (65%) were individual contributors, and 18% were first-level managers ('manager of people'). The remaining 17% were senior managers ('manager of managers'), a significant increase over the number of senior managers responding to the 2021 survey.

The consistent weighting towards individual contributors continues to reflect the more common use of online jobs boards like Animal Health Jobs to fill individual contributor and first level manager positions.

Staying the course: areas of consistency with the 2021 results

The generally positive view of the animal health industry was consistent with 2021 results. Respondents again revealed a devotion to the industry and its mission, a preference for staying in animal health when looking for new jobs, and a close ranking of the reasons for staying at work. Despite some challenges, they still see a positive future for the industry.

There's no place like home

In 2021, we noted that the overall view of the animal health industry was positive. Members felt a strong emotional connection to the industry, with a majority (70%) having no desire to work anywhere else.1

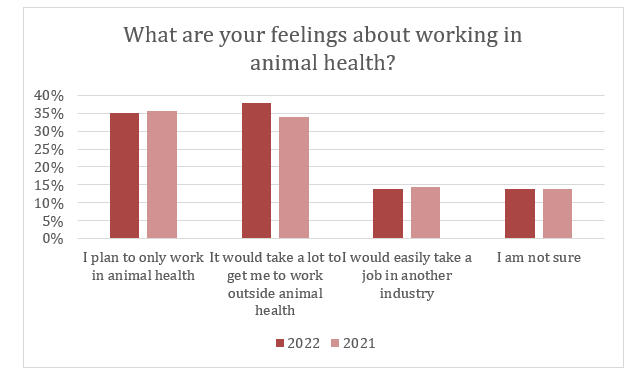

Our 2022 respondents remain committed to their industry. Of those with experience within and outside animal health, 72% planned only to work in the animal health industry from now forward or noted that it would "take a lot" to get them to work outside the industry. As in the 2021 survey, only 14% of respondents would "easily take another job outside of the animal health industry."

These positive were also shared in the free-text responses.

"Fulfilling, with a positive impact on the health of animals and the people [who] love and care for them "

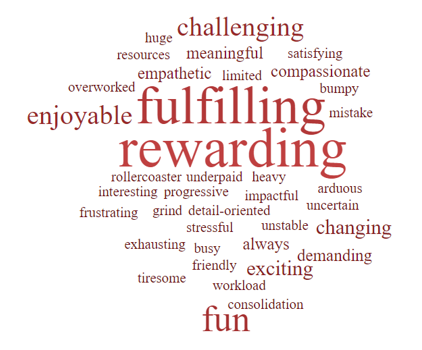

Three-quarters (72%) of respondents' comments were generally positive, including words like "fulfilling" and "rewarding." One respondent stated that s/he "wouldn't do it any other way."

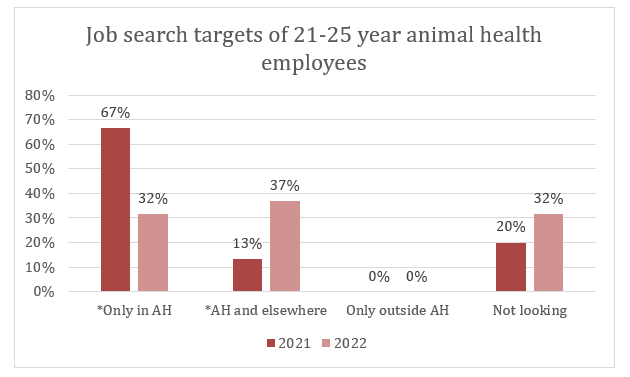

While there was little change in the overall percentage of people looking for new jobs (71% in 2022 vs. 75% in 2021), more of these jobseekers are now open to working in other industries. Even highly experienced animal health industry members are following this trend: Significantly fewer are actively looking for new roles in the animal health industry, and significantly more have expanded their search to other industries beyond animal health.

As in 2021, animal health employees are generally more stable: 36% of current animal health incumbents are not looking to make a move, while only 9% of those working outside animal health want to stay where they are. Animal health jobs and employees remain 'stickier' than those in other industries.

Why do you stay?

With so much news about the Great Resignation, why do people in animal health continue to buck the trend and stay in their jobs?

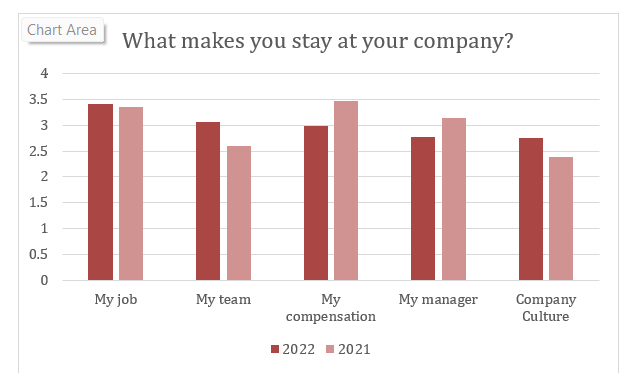

Respondents not actively looking for new roles ranked five predefined answers to the question, "What makes you stay at your current company?"

These five factors ranked even more closely together than in 2021, with a spread of 0.65 points in 2022 vs. 1.1 points in 2021. The ranking in order of importance (most to least important), was as follows:

- My job - the work is meaningful

- My team - I really enjoy the people I work with

- My compensation - my salary, benefits, and financial incentives

- My manager - I am supported, listened to, and respected

- The company culture - I like the way we do things and have strong core values

In 2021, more personal and practical factors (meaningful work and compensation) rose to the top.1 Interestingly, in 2022 compensation dropped from the highest rank to the third, overtaken by the job and the team. However, the closer clustering of all five factors makes it difficult to call out any one as most important.

Looking ahead

Overall, though, our respondents still see the future for the animal health industry as bright-eyed and bushy-tailed. When asked to rate the industry as a place to work and build a career (1 lowest, 10 highest), the average rating was again 8; respondents still see good times ahead. In 2022, slightly fewer respondents see a bright future (score 7-10) for the animal health industry (72% vs. 80% in 2021), although 4.9% rated the future for the industry "not bright" (0-3). None of these changes were significant.

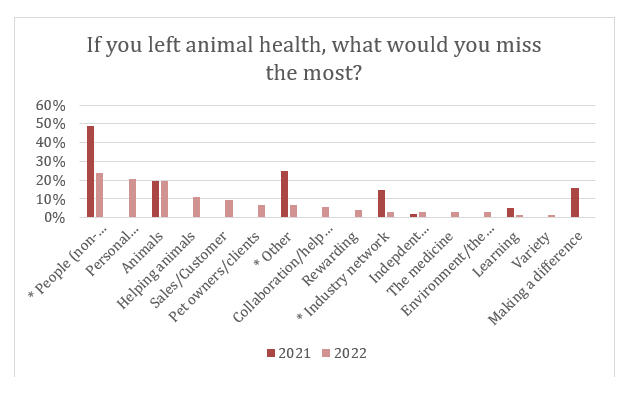

Engagement: what would you miss if you left?

We again evaluated employee engagement by asking respondents "If you left the animal health industry, what would you miss the most?" and collecting free-text responses.

Top items specified by respondents were the people and the industry network. We saw a significant increase in the percentage of those who would miss the people and a significant decrease in the percentage of those who would miss the industry network as compared to 2021 results.

Several respondents referred to the industry's core mission: 'Directly and indirectly helping animals" and "Helping animals - most of us do it for our passion to make the world better for pets" Others noted the special qualities of animal health people, from "cattle people" to veterinarians, staff, and pet owners.

"I don't think there are any other industries that I would feel the same way about."

Is there a fox circling the henhouse?

While most animal health employees remain happy at work, they are beginning to raise some concerns worth noting.

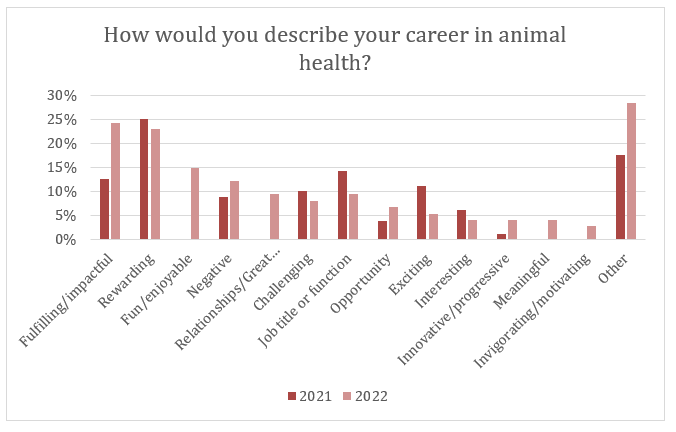

The three words respondents used most often to describe their careers in 2021 were rewarding, fulfilling, and exciting. In the 2022 survey, the top 3 were fulfilling/impactful, rewarding, and fun/enjoyable. However, the fourth most common set of terms were negative. As compared to fewer than 1 in 10 in the 2021 survey, this year 12% used descriptions like frustrating, stressful, and a roller coaster.

What words would you use to describe your career in the animal health industry?

Within these negative responses, 67% of complaints related to instability and corporate consolidation. Consolidation in the industry continues, with two-thirds of industry value now held by the top five companies.4 With consolidation comes the elimination of duplicate jobs and potential upheaval for employees.

In 2021, the global animal health industry grew 12%, significantly more than in the previous 10 years, primarily in the companion animal segment. Growth in this segment was driven by increased spending on pets and more adoptions during the pandemic. Companion animal veterinary clinics saw a 5% increase in practice visits and a 13% increase in practice revenue, both with peaks in spring 2021. The outlook for this side of the animal health industry remains good, despite the potential for inflation and increasing prices.4

By contrast, the livestock segment continued to experience turmoil. Increased export demand for both feeds and meat, supply chain interruptions, and lower output from meat-packing plants were among the factors leading to higher consumer food prices without a concomitant increase in prices paid to livestock farmers.4

The challenges to the livestock business remain in 2022. Supply chain disruptions, the loss of arable land in Ukraine and the effects of international sanctions against Russia will further increase feed and fertilizer prices. The American Farm Bureau Federation predicted that farm production costs in general will increase by 6%.5

In both livestock and companion animal medicine, the continuing COVID pandemic created great strains in veterinary practice. Staffing shortages and reduced productivity have led to increased burnout as veterinarians and staff worked longer hours under more pressure from clients and worries about their own health.4

Both areas bear watching. Rising production costs will squeeze livestock producers and could hold the farm animal market back. Skilled clinic employees may begin eyeing non-clinical industry jobs, increasing both competition for these roles and staffing shortages in veterinary clinics.

For more on the state of the industry and predictions for the future, see the Brakke Annual Industry Overview for 2022.

Of the responses including negative terms, 70% also included positive or neutral terms. A representative example was "interesting, challenging, frustrating."

Of the responses including negative terms, 70% also included positive or neutral terms. A representative example was "interesting, challenging, frustrating."

While not a significant change, the increase in the number of negative comments is worth investigating. Do your employees share these concerns? What can you do about them?

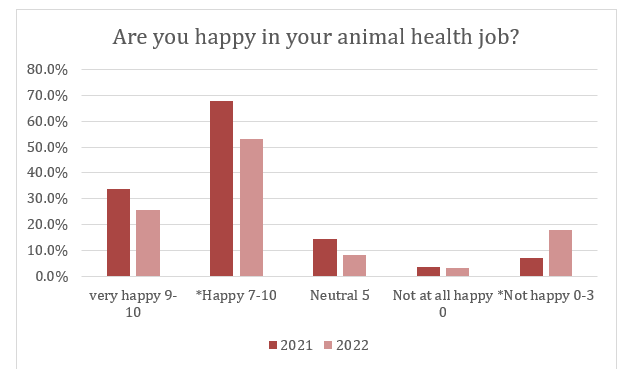

A happiness bubble?

Overall, respondents remain generally happy at work, with 47.6% describing themselves as "happy" or "very happy" and only 7.3% describing themselves as "not at all happy."

In 2021 68% of animal health incumbents described themselves as happy or very happy at work; in 2022 this number fell significantly to 53%. The number describing themselves as "not happy" or "not at all happy" also increased significantly, from 7% to 18%.

We have already noted the tremendous consolidation in the industry. Long-standing names like Bayer, Merial, and Novartis have disappeared. Veterinary practices are consolidating, with 75% of speciality/emergency practices and more than 25% of general practices, representing more than 50% of market share, now owned by corporate practices or consolidators.4

How is the culture in these companies changing? As a business grows, it becomes harder to maintain the informal or family-style culture that has been a characteristic of animal health for generations. Larger organizations require more controls to monitor compliance with company policies. Decision-making slows down or may move further up the management line. As the industry consolidates, is something special being lost along the way?

Do you want to join my herd?

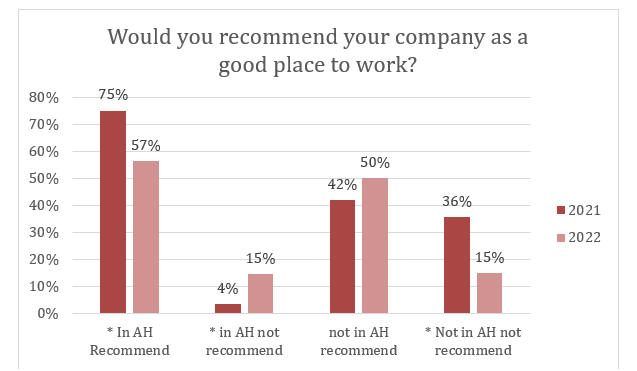

Job satisfaction often translates into referrals, which can be the source of a company's best hires. Despite the concerns noted above, most animal health employees would still recommend their company as a good place to work, with no significant differences reported from the 2021 survey. The mean score for all respondents was 7, the same as in 2021.

However, in 2022 vs. 2021 significantly fewer employees reported that they would recommend their company as a good place to work, and significantly more would not recommend it. The number of people who would not recommend their company rose significantly, from 4% to 15%. We wonder again if culture could be driving this employee dissatisfaction.

With these early signals of concern around culture, employee relations and overall satisfaction at work, wise managers would do well to pay attention. If the change is too much for many employees, how will you help them adjust? Is it possible to grow and maintain the special feeling of animal health?

Ipsos notes that almost one-third (30%) of employees are either actively looking for a new opportunity or would consider an outside offer. Company policies are important building blocks of corporate culture. Policies that address these employee concerns could make the difference between retaining and losing talent.6

We will revisit these questions in future surveys and report on the outcomes.

I'd rather stay in the barn: the attractions of working from home

After 2 years of COVID-related lockdowns and restrictions, working from home has become yet another part of the new normal. A new section of the survey explored respondents' views of this change.

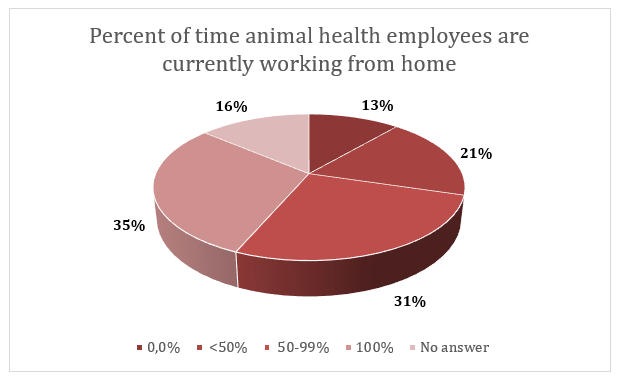

In our survey, 87% of respondents currently employed in animal health were working from home at least part of the time, with 66% working more than 50% from home.

When asked whether the option to work from home made a job offer more attractive, an impressive 93% of respondents agreed, and 70% strongly agreed; only 5% disagreed. Companies looking to attract and retain talent need to offer hybrid working.

The option to work from home is clearly a valuable benefit. Beyond questions of health in the face of a pandemic, what does it affect?

Getting it done

Though they love their colleagues, employees consider themselves more productive outside the office. When asked whether they were more productive when working from home or in a hybrid setup, 85% of respondents felt that they were indeed more productive, and 58% strongly agreed.

Am I still part of the herd?

At the same time, half (49%) of respondents found that working from home affected their feelings about the company's culture; 27% felt less connected to their company in a hybrid or work from home setup. This number was slightly higher among current animal health employees (29%) vs the total respondent population.

The safety factor

As we learn to live with COVID-19, employees are returning to their desks. Most employees feel comfortable about returning to an in-person work setup: overall 58% disagreed with the statement "I have significant safety concerns about returning to an in-person work setting." Among current animal health employees, that number was even higher, with 64% disagreeing with the statement. Fewer than 10% of animal health associates reporting feeling significant safety concerns, while 20% of respondents who did not work in animal health at the time of the survey were worried about going back to the office.

Conclusions

The animal health insiders responding to our surveys remain generally positive about the present and future of the animal health industry. The industry inspires a special level of commitment from its employees, based on the mission (helping animals) and the people (animal lovers and animal professionals). Employees are engaged and committed to their work and their companies.

Working from home is more than a successful means of adapting to pandemic conditions. It is a valuable job benefit that increases employee productivity. At the same time, animal health employees are comfortable coming back to the office and look forward to reconnecting in person with their customer and colleagues.

The 2022 Attitudinal Survey results contain some potential early warning signs about the impact of consolidation and change in the industry on its unique culture, as well as on employee relations and overall satisfaction at work. Animal health leaders should look honestly at their own organizations and take steps to prevent these potentially harmful changes from taking hold.

About Animal Health Jobs

Animal Health Jobs is a speciality marketplace connecting the best animal health and nutrition companies with top jobseekers. We create connections that drive innovation, growth, and the unique animal health culture. Visit us at www.animalhealthjobs.com.

Animal Health Jobs is a service of Brakke Consulting, the premier US consulting firm for animal health and its related industries. Brakke Consulting's team of seasoned professionals support animal health and nutrition companies in managing healthy, growing, and profitable businesses.

Brakke Consulting has been a key part of several landmark studies in the animal health industry. Industry insiders rely on the Brakke Annual Animal Health Industry Overview for insights into the future of the animal health industry. Visit us online at www.brakkeconsulting.com to learn more.

- Today Looks Good; Tomorrow Will be Even Better. Animal Health Jobs Survey of Candidate Attitudes About the Industry Spring 2021. https://animalhealthjobs.com/blog/2876/animal-health-jobs-survey-of-candidate-attitudes-about-the-industry-spring-2021

- Website United States Census Bureau: https://www.census.gov/quickfacts/US. Accessed 25 March 2022.

- Website American Veterinary Medicine Association (AVMA), US Veterinarians 2020: https://www.avma.org/resources-tools/reports-statistics/market-research-statistics-us-veterinarians Accessed 25 March 2022.

- Brakke Consulting: 2022 Animal Health Industry Overview presented 7 March 2022

- American Farm Bureau Federation. Market Intel: Analyzing Farm Inputs: The Cost to Farm Keeps Rising March 17, 2022. Accessed 28 March 2022. https://www.fb.org/newsroom/production-costs-outpacing-commodity-prices

- Incalcatera, Tony: How Back-to-Office Policies Resonate Throughout the Entire Economy: An Ipsos Point o View. March 2022. https://www.ipsos.com/en-us/knowledge/media-brand-communication/how-back-to-office-policies-resonate-throughout-the-entire-economy Accessed 9 April 2022.

Comments